A business continuity policy is the set of standards and guidelines an organization enforces to ensure resilience and proper risk management. Business continuity policies vary by organization and industry and require periodic updates as technologies evolve and business risks change.

The goal of a business continuity policy is to document what is needed to keep an organization operational during both ordinary business days and emergencies. A well-defined policy helps companies set realistic expectations for business continuity and disaster recovery (BCDR) processes. Additionally, these policies provide a structured approach to identifying and addressing vulnerabilities.

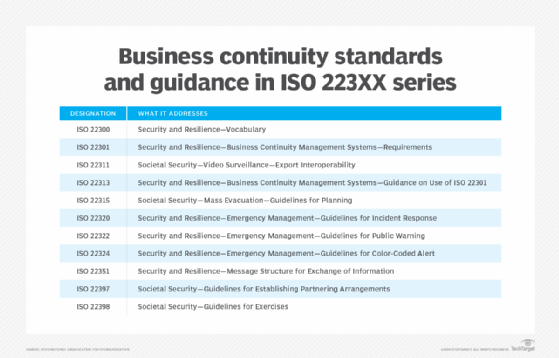

A business continuity policy is typically developed in accordance with industry best practices and regulatory requirements, including frameworks from the International Organization for Standardization (ISO), the British Standards Institution (BSI) and the National Institute of Standards and Technology (NIST).

Key components of a business continuity policy

While business continuity policies vary between organizations, they share common core elements, including staffing, performance metrics and compliance requirements.

Staffing and responsibilities

The business continuity policy should define the following roles and responsibilities:

- Department heads and corporate executives responsible for policy oversight.

- BCDR teams in charge of disaster recovery procedures.

- IT teams managing data protection, cybersecurity and cloud-based recovery solutions.

- External vendors, partners, and stakeholders involved in continuity planning.

Performance metrics and risk indicators

Organizations use key performance indicators (KPIs) and key risk indicators (KRIs) to monitor business continuity effectiveness and identify potential threats:

- KPIs measure recovery time objectives (RTOs), recovery point objectives (RPOs) and system uptime.

- KRIs assess the probability or risks such as cybersecurity breaches, supply chain disruptions, and operational downtime.

Compliance and regulatory standards

Business continuity policies should align with global and industry-specific regulations such as the following:

- ISO 22301:2019. International standard for Business Continuity Management Systems (BCMS).

- NIST 800-34. U.S. National Institute of Standards and Technology’s Contingency Planning Guide for IT Systems.

- BSI BS 25999. British Standards Institution’s business continuity management best practices.

- Industry-specific regulations, such as the General Data Protection Regulation, Health Insurance Portability and Accountability Act and Sarbanes-Oxley Act, which mandate data protection and operational resilience.

These standards help organizations maintain compliance, enhance risk mitigation and strengthen their ability to recover from disruptions.

What are some important BC policy considerations?

When crafting a business continuity policy, an organization should first consider the particular risks it is likely to face. Is the company in an area that frequently has hurricanes or other major weather events? Is there a geopolitical element that is problematic? Has ransomware or other malware ever created concerns? Organizations should consider all these factors when creating a business continuity policy.

A risk assessment is a reliable method of determining the likelihood of potential threats. A risk assessment identifies hazards and provides ways to reduce their impact on the business. Risk assessments commonly involve the following:

- Identifying the hazards.

- Determining what or who could be harmed.

- Evaluating the risks and creating control measures.

- Recording the findings.

- Reviewing and updating the assessment.

Along with a risk assessment, conducting a business impact analysis (BIA) can help form the backbone of a business continuity policy. A BIA determines the effects of a potential disaster on an organization by finding existing vulnerabilities. Though similar to a risk assessment, a BIA often occurs first and focuses primarily on the business impact and meeting recovery time and recovery point objectives.

Business continuity policy oversight and verification are other elements to be aware of if there are legal requirements to follow. A company executive or other leader may be designated as a liaison to the BCDR team, coordinating efforts to resolve any compliance issues. The BCDR team itself, along with any necessary internal departments, might be responsible for verifying policy compliance. In addition to setting up the procedures and staffing, the BCDR team should regularly verify policy compliance.

Corporate management might be brought in to address any deviation from the policy.

Business continuity policy oversight and compliance

To ensure the effectiveness of a business continuity policy, organizations must establish oversight mechanisms, which can include the following:

- Leadership involvement. A senior executive should oversee business continuity initiatives and coordinate between teams.

- BCDR team accountability. This team should be responsible for regular policy audits, compliance checks, and performance evaluations.

- Routine testing and audits. Organizations should conduct periodic reviews and simulations to test policy effectiveness and make necessary adjustments.

Corrective actions should be taken swiftly to address any failure to comply with business continuity policies. This will help the company remain aligned with organizational goals and regulatory requirements.

When to bring in a BCDR vendor

BCDR vendors and the services they provide can help a company advance the creation of a business continuity policy. Managed BCDR vendors can take on some of the work and facilitate tests of a business continuity strategy.

With the ubiquitous nature of the cloud, disaster recovery as a service (DRaaS) has become a popular BCDR option. DRaaS comes in all shapes and sizes, which makes it an appealing option. DRaaS is a fairly universal method to handle issues large or small.

Major DRaaS providers include Acronis, Amazon Web Services, Axcient, IBM, Unitrends, VMware and Zerto.

Business continuity policy vs. business continuity plan: How are they different?

A business continuity policy and business continuity plan (BCP) have a lot in common. Both address all the unique requirements of maintaining continuity. They serve different purposes, however. The policy outlines the standards to be followed and benchmarks to be met. A plan maps out from beginning to end how the organization will get through an event. Business continuity policy information should be included in the business continuity plan but as a separate entity.

A well-structured business continuity policy is essential for operational resilience, regulatory compliance and risk management. By integrating risk assessments, business impact analyses and compliance verification, organizations can strengthen their preparedness and response capabilities.

With the growing adoption of cloud-based BCDR solutions and AI-driven risk management tools, businesses can modernize their continuity planning and be well-prepared for evolving threats.

As enterprises rework their business models and strategies to meet various new challenges, risks abound. Explore common risk management failures and how to avoid them.